GENERAL TRENDS

Packaging Industry Outlook and Observations

The North American packaging market delivered robust performance in Q4 2024, propelled by sustained e-commerce growth, heightened focus on sustainability, and strategic mergers and acquisitions (M&A). Valued at approximately $210 billion in 2024, the sector —is projected to grow at a CAGR of 4.2% through 2030. Key growth drivers include rising demand for corrugated boxes, flexible packaging innovations, and eco-friendly alternatives aligned with regulatory momentum and consumer expectations.

Industry consolidation remains a defining trend as companies pursue acquisitions to diversify portfolios, enhance technological capabilities, and scale operations. Regulatory pressures, the e-commerce boom, and shifting consumer preferences toward sustainability continue to shape the North American competitive landscape.

Recent Trends

E-Commerce Growth and Last-Mile Packaging Needs

The growth of e-commerce remained a primary driver of packaging demand, with particular emphasis on corrugated boxes, protective packaging, and flexible mailers.

E-commerce sales grew 7% year-over-year, boosting demand for durable and lightweight packaging suited for fast-moving consumer goods (FMCG), electronics, and meal kits.

Sustainability as a Market Imperative

Sustainability emerged as a critical differentiator, with North American companies investing heavily in recyclable, compostable, and biodegradable materials.

Regulatory Pressure: The ban on single-use plastics in several U.S. states and Canada accelerated demand for eco-friendly alternatives.

Advances in Smart and Technological Packaging

The adoption of smart packaging technologies continued to rise, offering value-added features like product tracking, inventory management, and consumer engagement.

Growth in Protective and Flexible Packaging

Protective and flexible packaging solutions grew significantly, fueled by demand from the pharmaceutical, electronics, and FMCG sectors.

Notable Segments:

Temperature-controlled packaging for vaccines and medical products.

High-barrier flexible pouches for extended shelf life in food and beverages.

M&A Catalysts

Sustainability and Regulatory Compliance: Acquisitions centered on eco-friendly materials and technologies to meet North America’s stringent environmental regulations and consumer expectations.

E-Commerce Growth and Last-Mile Needs: Firms focused on expanding their capacity for e-commerce-centric packaging solutions, such as corrugated boxes and lightweight flexible packaging, through acquisitions.

Regional Manufacturing and Onshoring: To address supply chain vulnerabilities and reduce reliance on imports, companies prioritized local manufacturing facilities and materials sourcing.

Technology and Efficiency Gains: Investments in automation, AI, and smart packaging capabilities drove M&A activity, enabling firms to enhance operational efficiency and remain competitive.

Diversification Across End-Markets: Firms pursued acquisitions in high-growth sectors like pharmaceuticals, electronics, and industrial packaging to reduce dependence on traditional markets like FMCG.

M&A ACTIVITY

North American Packaging Transaction Velocity

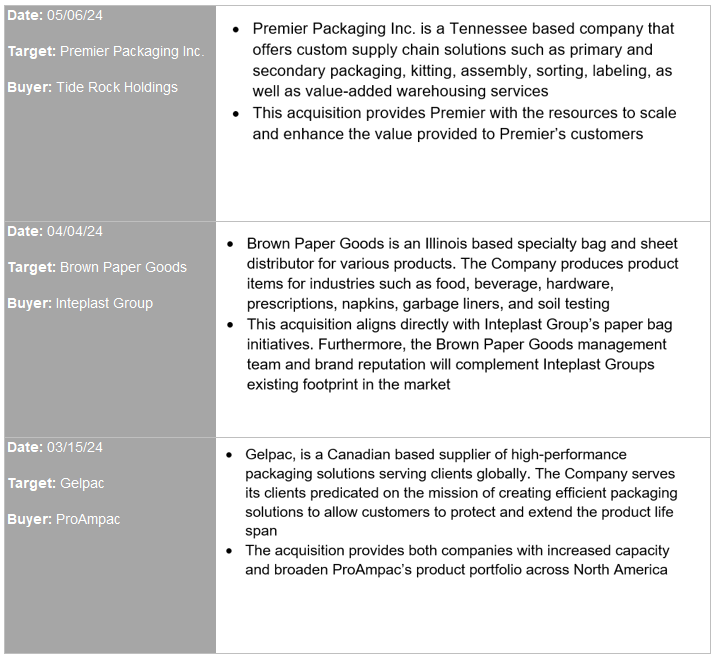

DEAL SPOTLIGHT

Creation of Smurfit WestRock

Market Presence: The combined entity positions itself as a global leader in sustainable packaging, with significant operations in North America, Europe, and other key regions.

Enhanced Market Position for Veritiv:

This acquisition significantly expands Veritiv’s footprint in the North American packaging market, bolstering its capabilities in industrial, retail, and specialty packaging distribution.

Veritiv gains access to Orora's robust customer base and established infrastructure, further diversifying its revenue streams.

Strategic Focus for Orora:

With the divestment of its North American packaging division, Orora transitions to a more focused strategy, prioritizing its beverage packaging business in the Australasian region.

The sale aligns with Orora’s long-term vision of becoming a market leader in sustainable and innovative beverage packaging solutions.

Date: 07/05/2024

Target: WestRock

Buyer: Smurfit Kappa

Transaction Value: $11B

Date: 12/11/2024

Target: Orora NA Packaging Solutions

Buyer: Veritiv Corporation

Transaction Value: $1.78B

CLICK HERE FOR 555 RELATED TRANSACTIONS

ABOUT 555 CAPITAL ADVISORS

Investment bank and advisory firm providing bespoke M&A, capital raise, and related services to middle market companies

Transactions: 100% Sale or Divestiture, Growth Capital, Recapitalizations, Mergers, Management Buyouts, Acquisition Advisory and Financing

Industries Served: Manufacturing, Business Services, Consumer, Technology, and Healthcare

Highly experienced and personalized client relationships: 25+ years experience, 100+ transactions, and mandates, customized solutions

The opinions expressed herein are those of 555 Capital Advisors. There is no guarantee that any predictions/projections as to certain market activity or events will come to fruition or past market or transaction performance referenced within will yield the same results as transactions previously conducted by 555 Capital Advisors.

Securities offered through Finalis Securities LLC Member FINRA & SIPC

This presentation contains information obtained from third parties, including but not limited to market data. 555 Capital Advisors believes such information to be accurate but has not independently verified such information. To the extent such information is obtained from third-party sources, there is a risk that the assumptions made and conclusions drawn by 555 Capital Advisors based on such representations are not accurate.