GENERAL TRENDS

Packaging Industry Outlook and Observations

The expansion of the size of key application industries such as food & beverages, pharmaceuticals, personal and household care, and the growing global penetration of e-retail has driven growth in the global plastic packaging industry with an expected CAGR of 3.5% from 2024 to 2030

The growing demand for the packaged food & beverage sector is driven by increasing population growth, changing lifestyle habits, rising economic activities, and increasing penetration of e-retail

The introduction of innovative packaging solutions such as active packaging and bioplastic packaging creates new avenues for the industry. However, rising sustainability awareness among consumers and bans from municipalities on single-use plastics pose a serious threat to the growth of the industry. Changing consumer preferences will continue to shape the plastics packaging industry

Thermoform technologies are another popular segment on the rise within the sustainable packaging industry. Analysts are predicting this segment will grow at the highest CAGR of 4.4% from 2024 to 2030

Increased e-commerce sales and changing consumer patterns are key drivers within the U.S. Packaging market, with expected valuation of $244.17 billion by 2029 and a CAGR of 6.5% globally

The rise in the levels of urbanization and the changing dietary habits have been the key drivers for growth within the flexible plastic packaging industry

The growing demands for packaging from food & beverage and healthcare products continue to drive growth within the flexible packaging market, with an expected valuation of $270.96 Billion in 2023, with an expected CAGR of 4.7%

M&A ACTIVITY

Global Packaging M&A Transaction Velocity

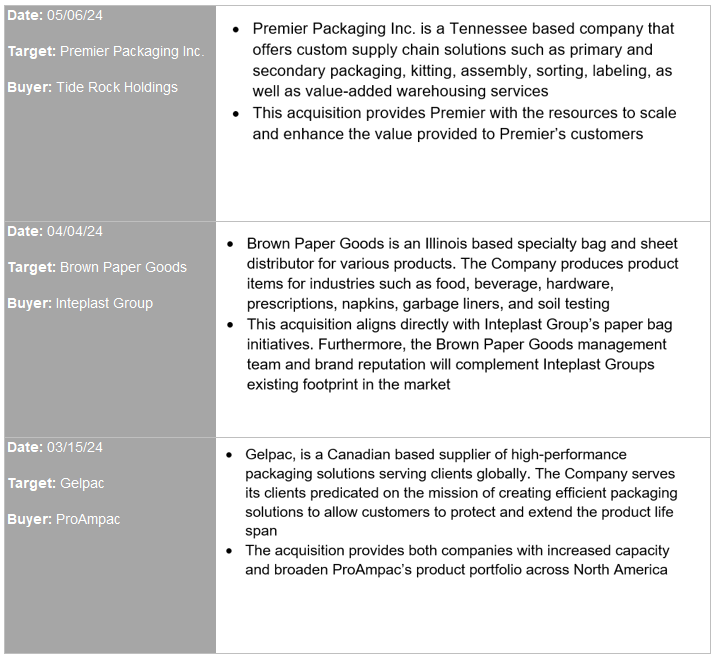

DEAL SPOTLIGHT

CLICK HERE FOR 555 RELATED TRANSACTIONS

ABOUT 555 CAPITAL ADVISORS

Investment bank and advisory firm providing bespoke M&A, capital raise, and related services to middle market companies

Transactions: 100% Sale or Divestiture, Growth Capital, Recapitalizations, Mergers, Management Buyouts, Acquisition Advisory and Financing

Industries Served: Manufacturing, Business Services, Consumer, Technology, and Healthcare

Highly experienced and personalized client relationships: 25+ years experience, 100+ transactions, and mandates, customized solutions

The opinions expressed herein are those of 555 Capital Advisors. There is no guarantee that any predictions/projections as to certain market activity or events will come to fruition or past market or transaction performance referenced within will yield the same results as transactions previously conducted by 555 Capital Advisors.